This article is about Banking and Finance

The Ongoing Transformation of the Banking System

By NIIT Editorial

Published on 24/02/2021

6 minutes

The banking system plays an essential role in the smooth functioning of every economy. The system needs to keep up the pace with the ever-evolving technology to meet the needs of the people. Hence, you will find the banking sector is constantly adapting to new developments and implementing the latest technologies.

Here are some significant ongoing transformations in the banking system.

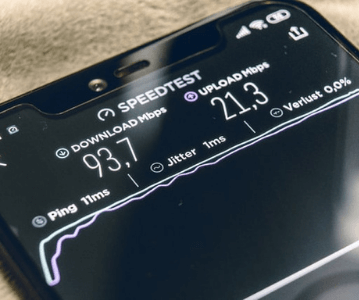

Increased adoption of mobile and contactless payments

Mobile and contactless payments form an important part of banking today and are finding widespread usage. According to NPCI, almost a third of Indian households are now using digital banking. They offer a convenient, easy and secured way of making payments, transferring money and other transactions. With the advent of seamlessly linked mobile payment technologies like the United Payments Interface, digital transactions have become easier. Other technologies like RFID and NFC have also contributed to the growing popularity of contactless payments.

Currency Exchange with e-Wallets

This is a useful feature for people staying abroad or those who frequently travel. Exchanging currency can be tedious. However, eWallets enable real-time currency exchange, making it easier to make payments wherever you are. They also help in eliminating the extra commission and other hassles that you have to go through for exchanging currency or making payments outside your home country.

A Convenient Banking Experience

Digital banking is the way forward. It has eliminated the need to visit the bank for every small requirement. You can now make bank transfers, check your account statement, request chequebooks, and conduct other transactions from the comfort of your home. Another benefit of digitised banking is that the experience is personalised for every customer- right from the choice of the colour of the interface, to the language you want the interaction in. This has made banking easier.

Implementation of voice-based virtual assistants

With the increased usage of voice search, the role of virtual assistants in banks is gaining importance. Banks are making use of voice-based assistants to make banking easier for their customers. The assistants can help you make payments, know your account balance, and conduct other banking transactions. Another benefit of virtual assistants is that they are of great help to those who are sight-impaired.

Adoption of Blockchain-based Smart Contracts

Business contracts can be long and confusing with many clauses. The contracts in the banking sector are even more complex. This has led banks to explore blockchain-based smart contracts. These are programs that execute according to the conditions set by the people who have developed them. Once implemented, these types of contracts assure all the participants of a pre-decided outcome considering the set conditions have been met. The best part about this is that there is no intermediary. Though this is still in its nascent stage, the adoption of these contracts will make business transactions easier for banks and companies.

Implementing these technologies calls for a workforce that is skilled and well-versed with the basics of the banking sector.

Keeping this in mind, NIIT has crafted well-rounded banking courses that teach you how the system works. You can choose a ‘Post Graduate Programme in Banking and Finance’ or the specialised ‘Priority programme’ or go for the ‘ANIIT - Banking and Finance’ dual qualification programme. You can take these banking courses as early as after your 12th. Once your basics are clear, you will then be well-equipped to handle the ongoing transformation in the banking sector.

Post Graduate Programme in Applied Finance and Accounts with GST

An online learning programme for Graduates that prepares them to be a multi-faceted, modern Finance, and Accounting professional.

Become an All Rounded Finance Professional

Assurance of 3 Interviews

Sign In

Sign In