This article is about Banking and Finance

Entry Level Careers in Banking and Finance & How to Get Them!

By NIIT Editorial

Published on 30/03/2020

6 Minutes

Banking is undoubtedly one of the most sorts after industries thanks to a galore of multi-disciplinary-verticals and lucrative professional roles. Collectively referred to as the Banking, Financial, Services, and Insurance sector (BFSI), the field offers as many career-advancing initiatives as it demands sustainable, hard-working inputs. Given the long-standing legacy of public and private institutions working in this sector, job seekers have a variety of opportunities to explore as far as careers in banking are concerned.

It is easy to draw the line between the public and private sectors in banking keeping in mind the Indian economic ecosystem of BFSI. A career in the banking sector in India, especially in one of the government banks would be a dream come true for not just those in Tier-2 or Tier-3 cities of India, but also the people residing in urban development centers such as Delhi, Mumbai, Chennai and Bengaluru to name some.

Why Build a Career in Banking Sector?

Major reasons for such an undying fascination with such jobs can be pointed to the following:

Demand – Although India is better than many first-world countries in terms of growth rate, yet 58.7% of its population remains unbanked. The scope of growth and employment generation to be expected in the immediate future from this fact alone is enormous. As public and private banks connect with the rural masses by opening up newer bank branches, the demand for both traditional and new banking career roles is sure to go up.

Innovation – The operational efficiency of the banks is expected to surge as well. This shift is partly credited to the now imperative push of digitization. Customers have taken a liking to the idea of mobile and internet banking with increased installations of ATMs within and outside their city quarters. Such 24/7 live facilities put convenience at the centre of the user experience and introduce a new level of customer service in banking driving the job requirement even further up.

Supervision – The government of India pays close attention to the fiscal policies introducing strong regulatory measures for the sector annually through its fiscal budget. Coupled with the above factors, the same assures a job security to people that is always welcomed.

You now have an understanding of the enthusiasm that surrounds job vacancies in this sector, let’s further explore the entry points into the same beginning with the public sector banks. Before we deep dive into the nature of these institutions, it is equally important to understand the nature of the jobs and are they good enough for building careers in banking or not!

Eligibility Criteria

Candidates must have a graduate degree with a minimum passing marks of 60% for the General category. Students from Other Backward Classes (OBC), Persons with Disabilities (Pwd) and Scheduled Castes/ Scheduled Tribes (SC/ST) are eligible to appear for exams with a minimum of 55% passing marks in graduation. Graduates are welcomed to apply to the following vacancies via annual exams:

Clerical: These are entry level jobs in bank(s) including designations such as clerks, typists, data entry/telephonic operators, clerk-cum-cashiers, and agricultural clerks. There

Probationary officers:

Candidates who successfully pass the exam are under probation for a pre-determined timeline in order to identify their key strengths and suited departments on the job. Once the probation period ends, they are hired and posted in the roles that are subsequently finalized.

There is enough reason to be positive about the scope of job security and employment opportunities within the banking sector. But in chasing this dream, students and job seekers alike should realize that it is akin to identifying 50% of the scenario. The other half of the lies in identifying the entry routes into such job profiles, be it the public or private banking sector.

A Careers in the Banking Sector - Public Sector

The Indian banking system is one of the most comprehensive in the world. Therefore it comes as no surprise that there are four institutions conducting annual examination for hiring at scale. These tests are recognized by the government and are as follows:

- Reserve Bank of India (RBI)

- State Bank of India (SBI)

- Institute of Banking Personnel Selection (IBPS)

- National Bank for Agricultural and Rural Development (NABARD)

Let us briefly understand the roles these institutions are hiring for.

Reserve Bank of India (RBI)

They conduct examinations for the Assistant Post and Grade B officers. As of this date, there are 630 vacancies for the RBI Grade B post, the examinations for which will be conducted in 2020. In addition to it, there are 926 vacant positions for the Assistant profile.

State Bank of India (SBI)

SBI hires for both its parent banking division as well as the five associate banks that include State Bank of Bikaner, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore, and State Bank of Hyderabad. Candidates are profiled to fill the positions of clerk and PO.

Institute of Banking Personnel Selection (IBPS)

It is essentially a recruitment firm that was founded to offer qualified people jobs in public sector banks. As a result of its standing legacy, a number of banks consider it’s scores to hire for various positions. The banks accepting IBPS scores include the Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Union Bank of India and Corporation Bank to name some. The range of roles they hire for include clerk, PO, Group-A (Scale I, II, III). This common entrance test is also considered by Regional Rural Banks to hire Group-B assistants as well as specialist officers in government banks.

National Bank for Agricultural and Rural Development (NABARD)

Based out of Maharashtra, NABARD aims to improve rural well-being of people by improving banking infrastructure and expanding banking functions. It recruits Grade A and Grade B officers for Assistant Manager and Managerial levels.

A Careers in the Banking Sector - Private Sector

Unlike nationalized banks, private or foreign banks don’t rely on common entrance examinations for hiring candidates. Many of them have their own bank courses for mass hiring and thereby promote a banking career. They tie up with corporate partners to first train and then hire skilled workers through standard certification programs. Such as the NIIT-ICICI Post Graduate Diploma for Senior Relationship Banking which is the perfect bank course for a job.

The programme has upskilled and placed thousands of candidates into the private banking sector. Candidates have to enrol for a 3-month programme at the end of which there is an examination. Once the student passes the examination they get a chance to work with the ICICI Bank in the profile of a Value Banker.

Few private banks take into account your IBPS score or CWE (Common Written Examination) score. After clearing the tests mentioned above, candidates can upload their results on the careers portal websites of private banks and apply for openings.

Benefits of Studying for Careers in Banking

The diaspora of options when it comes to careers in banking and finance is a field full of opportunities, especially in the Indian context. Be it students or unsettled job seekers, both sets finds ample scope of employment for a career in banking and finance industries with promising growth.

Job Security

There is a job security factor that is traditionally associated with the BFSI industry. Be it private or public banks, people tend to pursue careers in such profiles as they believe opportunities to earn promotions will be far and plenty.

Multiple Ways to Qualify

Considering that over 3 million people appear for banking examinations and a mere 0.5% qualify for the seats, the competition for jobs is stiff. Therefore, accredited academic institutions such as NIIT offer placement assurance bank programmes for students. Interested candidates send in their applications that are screened by experts and followed up with interviews. Once shortlisted, classroom training, now conducted purely online due to COVID-19, then preps students with on-the-job skills. One of NIIT’s latest flagships is the Priority Banking Programme that places students in Axis Bank in the role of a relationship manager.

Recognition

At the time of writing, NIIT offers multiple programmes affiliated by private banks as well as those that prepare students for a career in banking. They are:

- ICICI Post Graduate Diploma in Sales & Relationship Banking

- Axis Bank Priority Banking Programme

- Post Graduate Programme in Banking & Finance – Sales & Relationship Management

- Post Graduate Programme in Applied Finance & Accounts with GST

Over the years, thousands of students have benefitted from such programmes and cross industry partnerships that NIIT has created. For those who are recruited by a bank, it is a matter of pride and respect in the society. With the aforementioned programmes by NIIT, an aspirant that passes training assessments satisfactorily can attain the designation of a deputy manager in the bank. Along with that comes recognition among peers, something that can’t be brought by money, but earned only through effort.

Post Graduate Programme in Banking and Finance – Sales and Relationship Management

An online blended learning programme for graduates that prepares you in fields across Banking, Financial Services, Capital markets, Fintech and regulatory bodies & many more.

Become All-Rounded BFSI Professional

3 Assured Placement Interviews*

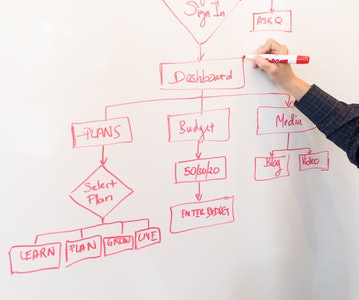

Sign In

Sign In