This article is about Banking and Finance

Investment Banking for Beginners – A Brief Overview

By NIIT Editorial

Published on 16/04/2020

6 minutes

What is Investment Banking?

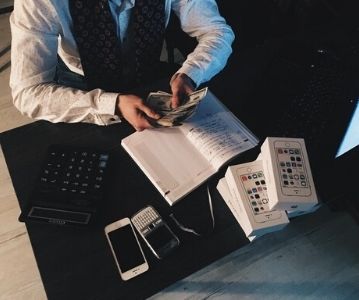

Businesses need capital to operate on and investors are always on the prowl to make handsome profits. Investment banks (IB) act as intermediaries operating in capital markets to procure funds for their corporate clients and/or government institutions from such investors. In principle, an investment bank could either be a sub-division of a much larger bank or could operate as a standalone business altogether.

When operating under a banking division, they are only allowed to conduct the proceedings for Mergers & Acquisitions and Underwriting for clients. Independent IB entities, however, are free to offer underwriting, M&A, equity research, asset management, retail/commercial banking and trading desks.

Services Offered by Investment Banks

Readers should be familiarized with an IB product offering now that they are aware of the investment banking definition. Their service offering is categorized under corporate finance, wherein an investment bank is expected to take up the following responsibilities:

- Mergers and Acquisitions – They play advisors at both the buying and the selling side, managing the M&A from the word go.

- Underwriting – This concept is specific to companies that raise money with an Initial Public Offering (IPO). Issuing shares is a big risk with variable forces playing their part in influencing the penultimate opening price. To mitigate risk and expedite the sell-off process, IBs offer the following value propositions to diversify their underwriting agreements:

- Firm Commitment – IBs assure a buy-back of any/all unsold security from the issuer.

- Best Efforts – IBs will allocate their resources to sell the complete proportion of the issuing securities, however, they are not liable for any left-overs, the ownership of which is returned to the security issuing authority.

- Minimum-Maximum – A condition-based scenario where IBs aim to hit a minimum threshold for selling the security, and subsequently aim to meet the upper ceiling of the target.

- All or None – IBs invite investors to participate in the security offering, as part of which the incoming funds are securely stored in an escrow account. Funds are only transferred to the issuer after completely selling the predetermined target, else, the IPO is called off and the funds are returned to investors.

Equity R&D – One product compliments another. The research on equities is utilized to update investors of the shape-shifts within the capital markets. Come to think of it, the same information could cross-promote the portion of stocks that the investment bank is trying to sell in the first place.

Asset Management – Assets could be anything from property, official equipment and loans to reserves, deposits, investments and securities. IB analysts should possess a diversified set of cognitive faculties to manage the same efficiently.

Being an investment banker is not everybody’s cup of tea. There are multiple facets to such a challenging position that requires a professional to be good enough, if not the best.

Skills Required to be an Investment Banker

Owning the right alongside gaining the trust to manage money for someone comes with its share of responsibilities. Investment Banking mandates professionals to be well-versed with the following set of credentials:

- Presentations – Sales is a vital component of this field with people having to visit their clients every now and then. Presentations are highly prioritized with a lot of facts and figures floating around. Having your hands set on visualization tools such as those from Microsoft suite or preparing pitch decks counts as a valuable advantage.

- Negotiating – Bankers take from one and sell to another. Having tabs on numbers is of no use if you don’t have the confidence to pitch the same to a listener and make-believe in your story. Negotiating to the boiling point is a signature trait of high-performing professionals in the industry. Either look for ways of acquiring such fast-track skills or the field would see to it that you do so in time, brutally.

- Business Development – This builds on the previous point. While product knowledge will add a gilded edge to your profile, it is savvy that you mould a sales-esque bend of mind. Of course, not everyone is natural at scoring such psychological wins over clients from day one, however, with time you would learn to offer the right value propositions.

- Business Valuation – We’re getting down the technical road now. Investment banking analysts should be fluent in computing valuation methods such as company analysis, Discounted Cash Flow analysis etc.

- Financial Modelling – Aspirants should have a, or be interested in gaining a working knowledge of Leverage buyout models, 3-statement models, along with other financial models used to calculate the performance of securities.

- Documentation – A key aspect of the industry is its huge emphasis on recording everything. Therefore, the understandable push towards properly archiving confidential information memorandums, preparing term sheets, and service level agreements to name some.

Top Investment Banking Firms

Investment Banks are segmented into three categories. The ‘Bulge Bracket’ denotes the elitist tier that capsizes with the likes of IB divisions of JPMorgan Chase, Goldman Sachs, Bofa Securities, Morgan Stanley, and Citigroup to name some. Some cater to the ‘Middle Market’ and third categorized as the ‘Boutique Market’ that are fundamentally standalone Investment Banking houses. The top investment banking firms in terms of revenue are:

- J.P. Morgan

- Goldman Sachs

- Morgan Stanley

- Bank of America

- Citigroup

- Barclays

- Credit Suisse

- Deutsche Bank

- Wells Fargo

- RBC Capital

- Jefferies Financial Group

With an ever-evolving financial structure of the banks and an equally complex array of financial instruments, Investment Banking is earmarked with challenges and opportunities alike.

Sign In

Sign In