This article is about Banking and Finance

What are the reasons to Choose E-learning Banking Courses?

By NIIT Editorial

Published on 10/11/2020

6 minutes

If you are looking to establish a career in banking, then improving your skillset is a must. A bank commonly comprises employees from a variety of backgrounds, both demographically and professionally. To bring everyone to a common platform and train them in the banking procedures is very important. A banking course tailored as per the particular bank’s requirements is, thus, needed for them to function efficiently. This is where E-learning courses come in.

What is E-learning?

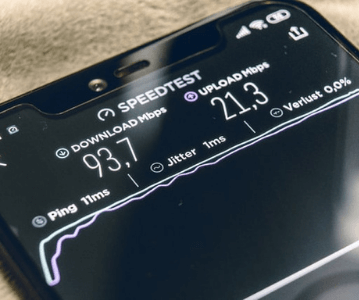

E-learning is becoming increasingly common these days. The E-learning system is a source of knowledge or teaching that uses electronic resources, such as computers and internet forms, among others. Employees are made aware of the working of the banks and taught other basic skills required to make a career in banking through E-classes online.

What are the advantages of E-learning?

E-learning courses have become quite popular in the banking domain. The advantages of E-learning are many. Here is a list of some major benefits of E-learning classes for the Banking, Financial Services, and Insurance (BFSI) sector.

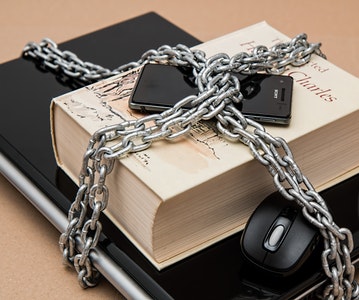

- The E-learning system allows the banks to maintain their privacy and secrecy of their operations. The internal material and procedures are safe, as the training and skill improvement process is controlled electronically. The sensitive data and information can also be secured with firewalls, protecting the data.

- The banking sector is known for its frequent change of rules. Thus, regular training in banking and finance is a must for all employees. Any human involvement might cause inefficiency as adapting to the rules takes time. Also, changing the training material for E-learning courses is comparatively easier. Thus, E-learning online education is a boon for the banking sector.

- The banking sector recruits people from all educational backgrounds. Thus, fitting in might be problematic for some. Also, with long training hours, dedicatedly attending a physical classroom course can be difficult. E-learning courses can be taken up at will from wherever you are. Thus, banks can easily train recruits using E-learning courses to teach banking ethics, the working code, the procedures, and even impart proprietary software training.

- E-learning is also a great tool to deliver compliance or regulatory training to your employees. The employees can learn a lot using case studies, scenarios, and reports. The employees can also be acquainted with the regulatory policies of the bank through e earning.

Why should you use E-Learning for Banking Employees?

There are several reasons E-learning courses should be preferred for training employees in the banking sector. We list some of the significant ones.

- A well-designed E-learning course will allow the banking employees to attain proper knowledge about their roles and duties in the bank.

- The IT skills of banking officials can be improved with E-learning courses. The banking officials will be more aware and comfortable using newer technologies.

- New recruits can also be swiftly inducted using E-learning courses. This improves the efficiency of the bank.

- E-learning is also a great way to keep the banking employees constantly updated about new rules and regulations, updates to government policies, and any changes to the bank processes.

- E-learning also makes it easier to track the training completion of bank employees and gauge their proficiency.

What are the challenges faced by E-learning courses?

Even though the superiority of E-learning courses over classroom training is clear, there are some challenges they face.

- A major challenge faced by the Banking Financial Services and Insurance (BFSI) sector is because of the huge number of employees at different locations throughout the nation. Regional diversity means that the procedures do not necessarily remain the same. Customising the courses to suit the regional requirements is a challenge for E-learning banking courses.

- E-learning courses conducted online also have limitations in training the bank employees who directly interact with the customers like those dealing with payments, mortgage, and loan approval processes.

- E-learning solutions require extensive hardware and software setup to cater to the large workforce of the BFSI sector. Also, a single bug and virus can wreak havoc in the entire system.

- Process training is an important part of training bank employees. Training employees on banking software without proper precautions in place via E-learning courses is also risky as it can compromise the data and pose threat to security.

Despite the challenges faced by E-learning courses, these systems are the future. With the current pandemic and social distancing norms in place, classroom training is best avoided. In this case, E-learning courses can be a saviour. Hence, it is advisable to start adopting E-learning courses online to learn things and train employees.

NIIT is a renowned name when it comes to training software and banking professionals. NIIT offers a range of banking-related E-learning courses that conform to the latest government standards. These courses are up to date and created in collaboration with major banks such as AXIS and ICICI.

With expert teachers experienced in the BFSI sector, comprehensive training material, and recognised certification, this is the perfect place for all your E-learning needs. Get in touch with the helpdesk or visit a nearby centre for more information.

Post Graduate Programme in Banking and Finance – Sales and Relationship Management

An online blended learning programme for graduates that prepares you in fields across Banking, Financial Services, Capital markets, Fintech and regulatory bodies & many more.

Become All-Rounded BFSI Professional

3 Assured Placement Interviews*

Sign In

Sign In