This article is about Banking and Finance

Your Dream Banking Career Is Ready, Are You?

By NIIT Editorial

Published on 02/04/2020

8 Minutes

Over the last few years, India has emerged at the world stage as a major investment destination. It displays all the signs of a thriving economy with multiple sectors showcasing record growth. One such sector is the Banking, Financial Services, and Insurance, or referred to simply as the BFSI. India has an immense scope of growth as the competition between private and public banks heats up. In this article, we’ll discover the current state of affairs of the BFSI sector and the ideal banking career in India for those aiming to enter the industry.

The Banking Sector Boom

India’s banking sector is backed by robust measures implemented at scale for the public by the Reserve Bank of India. Its policies and regulations are meant to ensure that the banking industry stays afloat with optimum capitalization and liquidation. Such factors were the force due to which India has withstood global financial meltdowns without taking severe damage. Lately, the banking authorities have standardized new banking models such as payments banks and microfinance banks that facilitate capital to those often left in the lurk.

Due to this diversity in Indian banking, there is a healthy mix of public and private enterprise activity. By an informal code, the public displays widespread trust in the national banking system, more so towards the public than private. This collective regard manifested in FY 19, wherein the public at large deposited its life savings in with pubic banks and bloated their assets under management to more than $1 trillion. Investments in the sector are bound to go up, due to new-age technologies facilitating banking to rural dwellers. As a matter of fact, it is expected that by 2021, there could be 407, 000 ATMs throughout the country.

Growth Rate of Banking Sector in India

There are a total of US $220 billion worth of deposits in the Indian banking system. On a macro-economic level, it has contributed to the development of the overall financial landscape. The opening of banking to foreign players and the introduction of digital banks has ushered an expansion wave for Indian banking ecosystem. From FY 16 – FY 20, deposits have grown at a common annual growth rate of 6.81 percent.

Government reforms are not far behind either. Last year’s union budget propelled the government to invest US $10 billion into public banks at the same time merging smaller banks into the public sector and revising the total public sector banks to 12, down from 20. There is a visible shift to encourage digital transformation in the industry. The emergence of digital lending platforms will augment this trend which is expected to rise from US$75 billion in FY 18 to US$1 trillion by FY 23.

As per a report by PwC, if India continues to reduce bureaucratic red tape and increase competition, it could become the third-largest banking sector by 2050, superseded by only China and the US.

The Diminishing Line b/w Public & Private Banks

The war between these two clans of the BFSI industry is fuelled by one major reason i.e., to cover the rural areas of India with the spread of their services. The competition is proving beneficial for customers with retail banking services getting cheaper and more diversified. This includes the introduction and spread of internet banking, mobile apps, more ATMs, so on and so forth. Interesting signs continue to emerge for the people employed in the Banking sector:

- There is an urgent need to upgrade the existing skillsets of professionals already employed in the sector.

- The future batches of banking professionals need to be trained on technologies and banking principles that will help them survive in the digital age.

It is also pretty clear, that the Indian mindset which used to prioritize government jobs over private, is changing. This is partly due to the reason as banking professionals are better paid in the private banking industry than in the public. Without going deep into the subject we can point out that this difference in salaries exists because nationalized banks are often subsidized by the government whereas private banks are run by investors and stakeholders who have quick access to funds.

Choosing Banking as a Career

From the above discussion, it is safe to say, that college graduates are positioned to have well-paying futures should they invest time in banking as a career, especially in the private sector. Unlike public banks that people pursue for a notion of job stability, career growth in private banking sector in India is incentive-driven. Banking professionals in the private sector get rewarded for achieving targets. They are also open to switching brands and working for a new employer for a chance to earn more.

But then there are a few questions that arise and need immediate answers:

- How to become a private banking employee?

- What are the entry level positions?

- How much do bankers in such positions get paid?

- Is there any job security in such profiles?

The qualification for bank jobs varies from one profile to another and also on the nature of entrance examinations, if any. But private banks do not conduct such entrance examinations. In most cases, the vacancies are listed on the “careers page” of their website and the qualification for bank jobs of such nature are much more streamlined and high on skill.

There is another way that you can apply. Very often, private banks partner with Education Institutions. These institutes run short-term programs on behalf of the bank shortlisting students who are ready for the banking industry. Their training curriculum varies from one profile to another. But one thing is for sure, such job profiles, that the bank hires for in bulk are mostly entry-level. The total number of banks in India is increasing rapidly. There are 12 reformed public sector banks, 21 private sector banks, 49 foreign banks, 59 regional rural banks, and 1562 urban cooperative banks.

Such an indirect route is well suited for students who for some or the other, are left out of the race of common entrance examinations. Although sponsored, such programmes have over the last decade emerged as a key gate-opener for unemployed but talented youth across India. For instance, NIIT’s Institute of Finance, Banking & Insurance, better known as IFBI which has crafted over 50,000 success stories by validating and placing the talent of college graduates with the ICICI Bank.

NIIT IFBI Changing Lives

With so many banks out there it could be hard to select, and then land a job in the bank of your choosing, because the competition is equally stiff. College graduates should first sort a programme for themselves that would land them a respectable position and create further opportunities to grow ahead. NIIT founded the Institute of Finance, Banking & Insurance in 2006 to help students plan and step into promising banking careers. It is shortly referred to as IFBI.

This institute was founded in association with the ICICI Bank to train and hire the next generation of banking professionals. Over a period of 14 years, more than 50,000 students have benefited directly from short term educational programs coordinated by NIIT IFBI, especially its Post Graduate Diploma in Sales and Relationship Banking, PGDSRB. Earlier known as the Post Graduate Diploma in Banking Operations, or simply PGDBO.

The program is suited to graduates aiming for an entry-level position in the private banking industry. Students are trained on essential banking fundamentals along with proprietary Finacle software used by ICICI. The training kit is designed to also educate people on the operational and sales aspects of entry-level positions in the ICICI Bank. Individuals who pass the course-examination and clear the interviews with the ICICI Bank are hired as Value Bankers. By virtue of this career course, thousands of students have commenced their career in the banking sector. This includes especially those who were looking for a banking career after 12th.

Who is a Value Banker?

The qualification for bank jobs of this cadre requires an individual to be between 19 – 25 years of age, with an accredited graduate degree in any discipline. A Value Banker is an umbrella term that is used by ICICI bank. The official designation allotted to the individual coming into this role could be different. This could perhaps be the result of their performance in the interview and their core strengths as analyzed by the recruiters in attributing an ICICI career role to the individual.

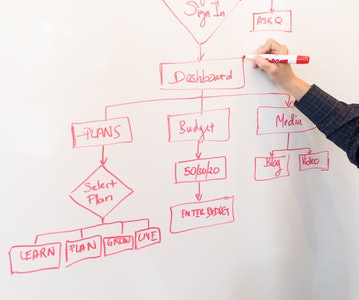

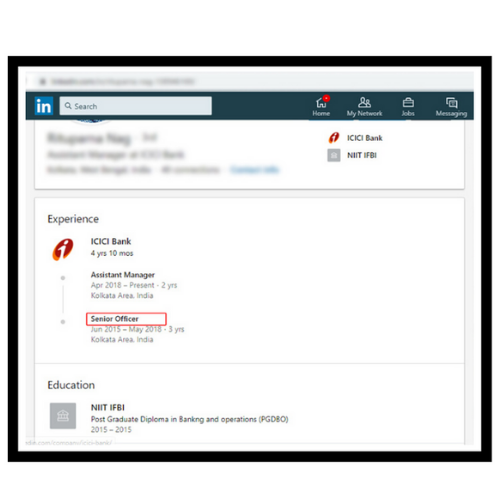

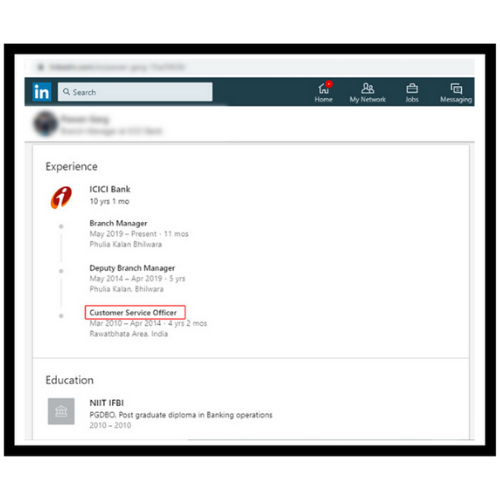

The IFBI PGDSRB has been in the market for over 10 years. It has been observed that people are often hired as Officers, Senior Officers, or even Customer Service Officers as indicated in the images. The officer/senior officer roles come under the entry-level bracket of the banks.

The IFBI PGDSRB has been in the market for over 10 years. It has been observed that people have often begun their careers in the banking sector as an Officer, Senior Officer, or even Customer Service Officer, with the PGDSRB, as indicated in the images. Applicants starting their ICICI career as officer/senior officers fall under the entry-level bracket of the bank. For many, it’s a dream to get insurance training at ICICI Bank.

Once the bank decides the roles and responsibilities as a Value Banker, it is under an individual’s control to put in the efforts. The scenario is the same in any job. Those who meet their targets, get promoted timely to higher positions but that happens after the first 2-3 years.

The next level in the hierarchy is the Probationary Officer. This is typically the scale of an Assistant Manager. Again, those who deliver results at this level for 2-3 years are promoted to the level of a Deputy Manager wherein the average tenure before another promotion is 2-3 years. By such an estimate, if a professional begins his/her journey with the ICICI around the graduating age of 21-22 years, they have a promising chance of becoming a Branch Manager by the age of 30 years (or even earlier) after undergoing NIIT IFBI’s PGDSRB.

Conclusion

NIIT IFBI’s PGDSRB has placed more than 50,000 students in the Banking, Financial Services and Insurance industry better known as BFSI. Hard-working professionals with their dedication have proven that with a sure short process to enter the BFSI industry, career growth in the private banking sector in India is definitely possible. The question is, do you want to test that limit or not?

PG Diploma in Sales and Relationship Banking

An online blended learning programme for graduates that gives you a job as a Value Banker with ICICI Bank, India’s leading private sector bank.

Assured Job Opportunity*

Role as a Value Banker

Sign In

Sign In