This article is about Banking and Finance

Is Becoming a Bank Probationary Officer better than doing an IT Job?

By NIIT Editorial

Published on 22/04/2020

10 minutes

India is a developing country with a rapid pace of progress in all industry sectors and if experts are to be believed, it would continue to be so for a long time to come. The Banking, Financial Services and Insurance sector vs the Information Technology sector will be a much-heated debate. The growth of the financial sector in India is estimated at 8.5% per year. On the other hand, the IT wing of the economy has in recent years (2016-2017) even boasted a growth rate of 12-15%.

With the scope of employment bound to grow in both sectors, job seekers have a tough choice to make in deciding between banking and IT careers. A prudent decision can only be reached after weighing one against the other, so let us break down our answer into basic details that one must consider while making this choice.

FYI about Probationary Officers

A Probationary Officer is the entry-level position in a bank, at which a professional undergoes a training of 2 years before being provisioned to serve as an Assistant Manager. Probationary officer work responsibilities include the following:

- Handle customer interaction

- Cheque clearance

- Cash management

- Business development

- Bank PO vs IT Jobs – Barriers to Entry

It’s time to address the second most frequently asked question, how to become probationary officer in a bank?

There are two ways to become a bank PO.

The first one requires interested candidates to apply through IBPS and SBI common written examinations. With limited seats and a 3-stage examination spread-out over Preliminaries, Mains and Interviews candidates should expect a tough fight. The minimum age for eligibility is between 20 – 30 years. Also, the maximum number of test attempts are capped at 4 for the General category and 7 for the Reserved (SC/ST) categories. Bearing in mind these, the chances to pass the test are few and far between.

There is a long but promising alternative route to becoming a probationary officer. It begins at NIIT IFBI via its 45-day classroom training program, the Post Graduate Diploma in Sales and Relationship Banking. Candidates are screened through interviews and an examination passing which they are handed provisional offer letters. It mentions the Terms & Conditions of the programme and the procedure to get into ICICI, post programme completion. After carefully evaluating the prospects students can decide if they want to enrol in the programme or not. Data suggests many students who take this journey, find themselves at officer-grade, entry-level positions in the ICICI Bank. Designations include titles such as Customer Service officer or a Senior Officer.

By hierarchy, such value banking roles are just one step below the grade of a probationary officer. Provided the individual performs well and gets a positive review upon an assessment by ICICI authorities, they could be promoted to the position of a PO within 2-3 years of joining the bank and thereupon begin handling the nominal Probationary Officer work load.

To keep things in perspective, but for the entrance exams and short-term courses like the one mentioned above, it is relatively harder to enter the banking industry. However, an individual with the right qualifications has numerous options to explore within the IT industry. The basic qualification a student is expected to have is engineering following which additional skill-sets can be acquired on the job or through third-party upskilling programmes.

- Bank PO vs IT Jobs – Job Security

Probationary Officer jobs are both in the public as well as the private sector. The same rule applies to government jobs applies to the Bank PO of a public sector bank as well. And that rule is, your future is safe. As we step into the future, there will professionals are required to update themselves with appropriate knowledge to stay relevant to the workplace. When it comes to the banking industry, such workforce upskilling initiatives are at the discretion of the banking authority i.e. they will undertake an organization-wide professional upskilling if there is a need to. That is because the software and system requirements availed by the employees differ from one bank to another and could be entirely proprietary.

The same cannot be said of the companies in the IT industry. Many, IT companies could deploy the same software solutions. Over time, this has created a huge market for e-learning platforms where professionals can train themselves with the latest in-demand skills (more on this in the next section). Whereas on one hand, this becomes an opportunity it leaves the possibility open for an organization to become complacent. In simple words, they may not opt for mandating upskilling for the workforce until the need is critical. Similarly, they could choose to hire a more qualified or more experienced candidate than invest in their employees.

From this standpoint, having a job as a Bank PO, especially in the public sector, is better than acting one out of the herd and chasing “ideal” IT careers.

- Bank PO vs IT Jobs – Salary

The salaries vary for public as well as private sector bank POs in India. For public sector banks, the total cost to company i.e. CTC of a bank PO could be between Rs. 7 lakhs to 10 lakhs per annum. This includes salary components like HRA, special allowance, as well as the dearness allowance. For private sector banks the salary for the same profile ranges between Rs. 4 lakhs to Rs. 7 lakhs.

Salaries for the IT worker are much lower in this regard ranging between 2.5 lakhs to 3 lakh rupees a year. Truth be told, it would take such an employee a good 3-4 years along with upskilling to match the salary slab of a bank PO.

- Bank PO vs IT Jobs – Perks

In terms of perks, Bank POs are entitled to pension savings, medical reimbursements, and travel expenses as part of the perks. Some bank IT officer jobs might have a broader scope of extending benefits to those in the tech department. But on the whole, perks depend from one IT job profile to another in the private sector. Such a long term savings prospect is a major reason why so many people rave about Probationary Officer jobs instead of the latter.

- Bank PO vs IT Jobs – Work Life Balance

Usually, government jobs demand officers to report six days a week at the workplace which leaves 2 full weekends for family responsibilities to be fulfilled. In this particular point, IT jobs score a point as most, if not all, organizations offer 5-days working with weekends off.

- Bank PO vs IT Jobs – Career Growth

It has to be said that Information Technology provides greater prospects for salaries. As elaborated in the previous section, IT is always changing and mutual software and infrastructural needs between organizations have created a perfect environment for online education to allow individuals to learn at will. The better and more advanced your skill sets, the greater the earning potential you carry. As a result of this, IT professionals move from one company to another in search of recognition and acknowledgement of their talent.

But the same cannot be said for a Probationary Officer who works in a bank, especially public. It happens rarely, if at all, that an individual leaves his/her government job. People enter such a profession having resorted to the fact that income growth would be limited. In addition to this, they’ll be a long-standing employee with a single institution. Their primary aim is stability. An IT professional starting his/her career at the same time as a Bank PO can earn exponentially better than them. Private banking employees could still, compete to some extent in terms of salaries by changing banks, but not the people employed in a government bank. Hence, for faster career growth IT careers stand out as the better choice.

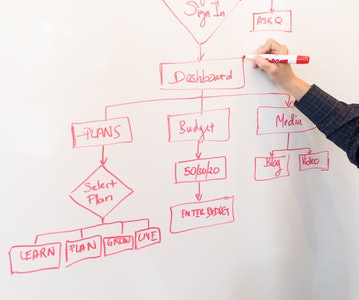

PG Diploma in Sales and Relationship Banking

An online blended learning programme for graduates that gives you a job as a Value Banker with ICICI Bank, India’s leading private sector bank.

Assured Job Opportunity*

Role as a Value Banker

Sign In

Sign In