This article is about Banking and Finance

A Beginners’ Guide to Mutual Funds

By NIIT Editorial

Published on 18/06/2020

9 Minutes

Mutual Funds investment is a scheme with financial incentives targeted toward the masses and managed by professional fund managers. Financial institutions such as an Asset Management Company attracts investments from a pool of investors and allocates these collections towards the purchase of bonds, stocks and other financial instruments. Mutual Funds are a perfect option for people who would want to take advantage of the stock market but lack the technical knowledge to do so. The Asset Management Company charges investors an annual maintenance charge, also called an expense ratio, to keep the fund running. The investors make money through capital gains that are profits registered through the purchase and sale of financial instruments by fund managers. The investors have two options to act on this profit margin. They can either re-invest it in the fund via a growth option or claim their profits through a dividend option.

In this guide, we’ll tackle fundamental questions such as how to invest in mutual funds for beginners in India, types of mutual funds in India and how to go about investing in them.

Benefits of Investing in a Mutual Fund

We begin this mutual funds investment guide beginners would want to read with the benefits of investing such financial schemes.

Transparent Process

A single AMC will run multiple investment funds at the same time. Enrolling into them is an online, hassle-less procedure. You can choose to park your money in one open-end fund and expect to reap profits over time. There is an option to switch funds as well.

Easy to Invest

People are often finicky about their money, and rightly so. Be that as it may, you can begin by investing as little an amount as Rs500 into a Systematic Investment Plan (SIP). On the other hand, if you are confident about the fund’s potential, you can go ahead with a lump sum investment as well.

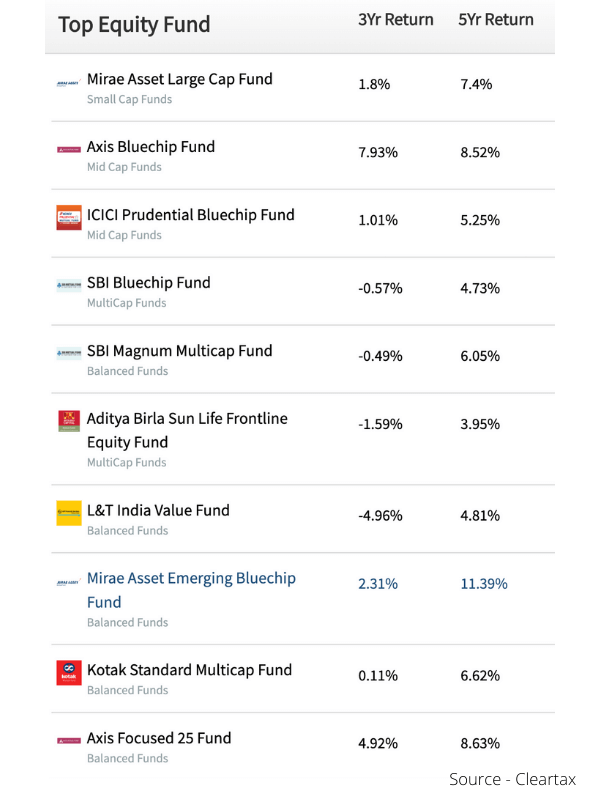

Plausible Good Returns

Equity funds with a maturity period of over 5 years are known to produce a return of at least 15% or higher. This is almost double the return of fixed income deposits such as FDs that promise a return of 8% maximum (in the case of PNB Housing Finance) as of writing.

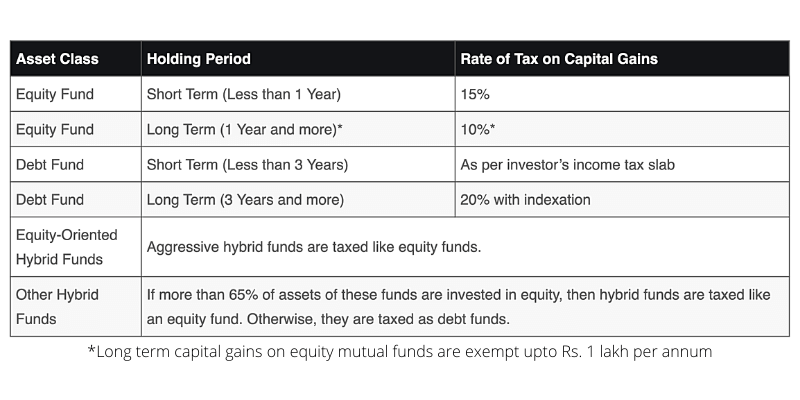

Tax Mitigation

To encourage mass participation in the stock market, the government of India gives special consideration to mutual funds under Section 80C that also applies to various other financial instruments. For instance, with Equity Linked Savings Scheme (ELSS), that is a type of equity mutual fund with a money lock-in period of 3-years, saves up to Rs1, 50, 000annually for investors.

Professional Expertise

The AMC assigns a Fund Manager with a proven track record that in turn work with financial analysts to rebalance the portfolio from time to time. Therefore, retail investors can breathe a sigh of relief and place their money with good confidence under the care of investment houses. In addition to this, there is government supervision under the Securities and Exchange Board of India (SEBI), and the Association of Mutual Funds in India (ANFI) to ensure full compliance with regulatory guidelines.

Types of Mutual Funds in India

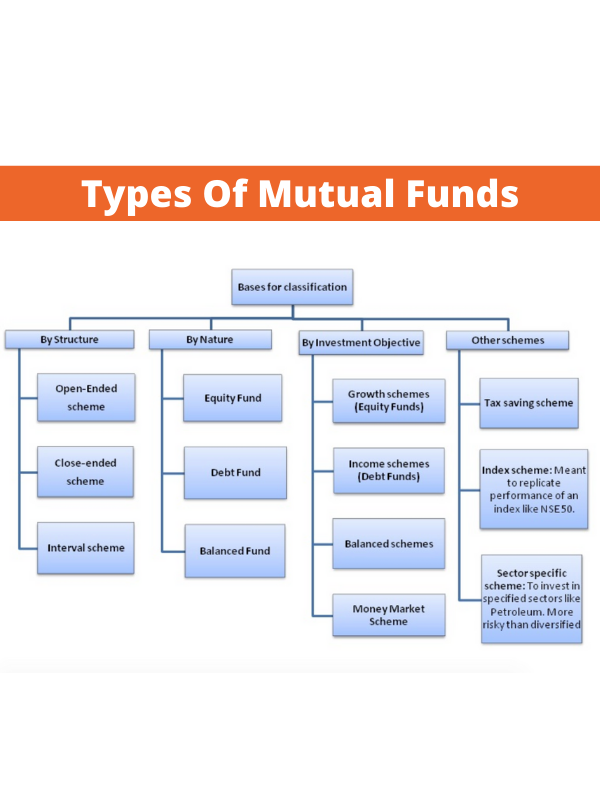

There are 3 types of mutual funds by nature as advocated by SEB.

1. Equity Funds

Equity funds allocate as much as 65% of their total capital towards financial instruments in the equity market. Equity markets is another term for the stock market. Therefore equity funds invest in financial instruments such as stocks, bonds, shares etc. The remaining 35% of the funds can be invested in money market securities some of which include Repurchase Agreements (RA), Certificate of Deposits (CDs), Treasury Bills and Banker’s Acceptance (BA). Equity funds can further be divided into the following:

- Small-Cap Funds

Small cap companies are those ranked below the top 250 listed companies on the exchange by market capitalization. There is another metric that suggests, business with less than 5000 crore in market value to be classified as small cap. Small Cap Funds focus on such small cap companies.

Such companies hold immense potential for future growth. They are considered a high-risk investment, as there is no assurance of a stable return unless the companies display an appetite for innovation. Income from such funds, if withdrawn before 1 year from the date of investment, are taxable at 15% and none after the fact.

- Mid Cap Funds

In India, Mid Cap companies are those that have a market capitalization between Rs.5000 crores and less than Rs.20, 000 crores. Mid Cap funds invest in companies with mid-sized valuations. Such investments are considered safer than small-cap funds but riskier than large-cap funds. Given the fact that the companies are established, there is a good chance that such investments might return a good profit in a short time.

- Large Cap Funds

These funds allocate a major portion of their portfolio to corporations with huge market capitalisation. Since there is already a high trust index attached to the company’s long-standing reputation, investment in large-cap equity funds in considered profoundly safe. Companies falling under this umbrella have a market capitalisation of Rs20, 000 crores. They are best known for stable returns and gains from such investments are non-taxable if withdrawn after one year from the date of investment. However, if you do so before completing one year, then capital gains are subject to a 15% tax.

- Multi-Cap Mutual funds

Fund managers, looking after multi-cap funds diversify the capital across a range of companies spanning small, mid-size and large corporations. They are considered relatively safe for first-time investors and have a low-risk return.

- Sector Mutual Funds

They invest in particular sectors such as banking, rural, Public Sector Units etc. Since all their eggs are in one basket, they are a risky proposition in comparison to multi-sector funds that diversify their investments by focusing on multiple sectors such as pharmaceutical, Information Technology etc. Sector Mutual Funds are better suited to informed investors who stay up to date with macro and microeconomic shifts and who can identify future signs of a boom/bust in a particular sector.

- Index Mutual Funds

Such mutual funds are modelled to replicate the performance of a market index an example of which would be Nifty, Sensex etc. They are also referred to as Exchange Traded Funds (ETF). Since they are matched to the performance of the market, Index Mutual Funds pose low returns against the aforementioned categories.

- Equity Linked Savings Scheme (ELSS)

They provide investors with an opportunity to save a good amount of tax while reaping dividends in the market. Fund managers invest money in multiple equity securities therefore and hold the promise of going one up against the market average. Their lock-in period is 3 years.

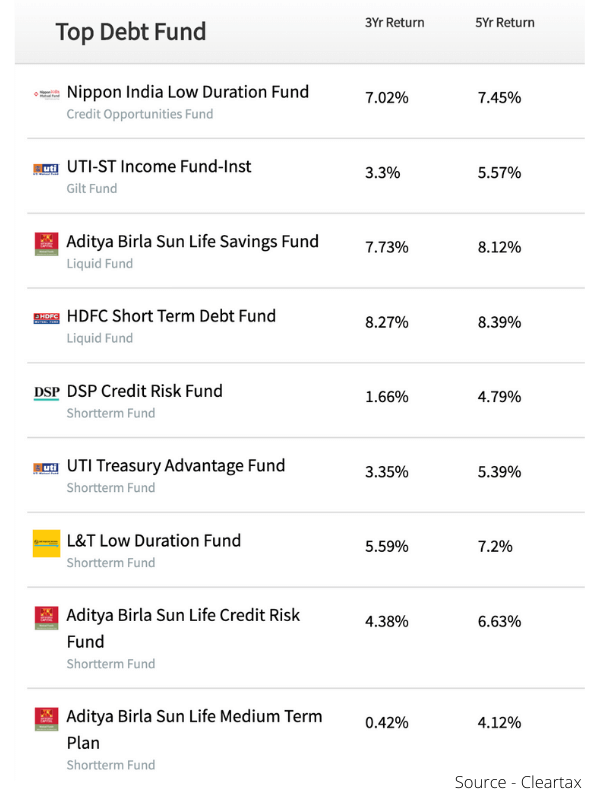

2. Debt Mutual Fund

Debt Mutual Funds invest the majority of their investment in money market securities the upper limit of which is 65%. They are of the following types:

- Overnight Fund

They invest in securities having a maturity of just one day. Hence the name overnight fund. Examples include reverse repo, Collateralized Borrowing and Lending Obligation (CBLO) etc.

- Liquid Fund

Financial houses running such schemes invest money in debt and money market securities that have a maturity of 91 days.

- Ultra Duration Fund

Macaulay duration is the measure of the total time that a scheme can take to even out to regain the investment. Ultra duration funds invest money in debt and money market instruments that typically have a Macaulay duration of 3 – 6 months.

- Low Duration Fund

They target money market securities that can mature in a duration of 6 – 12 months.

- Money Market Fund

These funds typically mature in about one year.

- Short Duration

The security portfolio invested in through Short-Duration funds has a maturing time of about 1 -3 years.

- Medium Duration Fund

Here, the purchased securities have a maturing time of 3 - 4 years.

- Medium to Long Duration Fund

Investors who can park their capital for about 4-7 years are recommended to invest in this fund.

- Long Duration Fund

The invested securities have a long maturity time which is often greater than 7 years.

- Dynamic Bond Fund

These funds flexibly invest across all the categories of debt mutual funds discussed till now.

- Corporate Bond Fund

Such funds have the regulatory approval to invest up to 80% of their investments in high-yield corporate bonds.

- Credit Risk Fund

Corporate bonds are classified as senior, senior secured, senior unsecured, subordinated, investment grade, high yield, and convertible bonds. When it comes to Credit Risk Funds they invest in corporate bonds rated below the high-yield class.

- Banking and PSU fund

They target debt-based financial instruments of banking institutions, Public Financial institution, and Public Sector Undertakings.

- Gilt Fund

They can invest up to 80% of their capital into government-backed securities.

- Gilt Fund with 10-year Constant Duration

It invests in securities with a maturity of 10 years.

- Floater fund

They can invest up to 65% of the total investor money into Floating Rate Instruments.

3. Hybrid Funds

Just as the term hybrid connotes, such funds invest in both Equities as well as Debt securities for profit maximisation. As a result of this, their portfolio performance is competitive with Equity funds, while at the same time reducing their risk exposure to a market fallout. They are classified into the following types based on the proportion of equity to debt investments they make:

- Conservative Hybrid Fund

Such schemes invest 75% – 90% of their capital in debt instruments, and the remaining 25% – 10% in equity securities. Debt securities are symbolic of stable but low returns, and since that makes up 3.4th of such mutual funds, they are names “conservative”.

- Balanced Hybrid Fund

As per SEBI’s latest guidelines, a Balanced Hybrid Mutual Fund has to invest 40% - 60% in debt securities. Before SEBI’s redefinition of the category, the asset allocation used to be confusing for observers where somewhere between 65% - 80% was allocated towards equity-based instruments.

- Aggressive Hybrid Fund

SEBI mandates Mutual Funds to label their hybridized investment of the ratio 65% - 80% towards equity assets, as an Aggressive Hybrid Fund. Moreover, a financial company can offer either a Balanced Hybrid Fund or an Aggressive one but not both as products.

- Dynamic Asset Allocation/Balanced Advantage Fund

As the name suggests, the fund dynamically adjusts between debt and equity securities. There are is no rigid regulation that limits the proportion of asset allocation to either type of securities.

- Multi-Asset Allocation Fund

Multi-Asset Allocation Funds distribute their investments across all the 3 asset classes with a minimum investment threshold of 10%. They are open-ended by nature and basis the prevailing market conditions continue to diversify share-holdings to minimize risk and maximise returns.

- Arbitrage Funds

In finance, arbitrage refers to the purchasing of assets from one marketplace, example a stock exchange, and selling the same asset on a different stock exchange to take advantage of price differentials. Since such funds do not deal with stocks, they are relatively independent of the risk associated with equity securities. Arbitrage Funds perform the best in times of market instability. Their performance is comparable to liquid funds.

- Equity Savings Funds

Fund managers operating such schemes spread the investments across equity, debt and arbitrage financial instruments. They can adopt strategies for actively hedging their bets by investing capital into derivatives. For taxation purposes, Equity Savings Funds are considered Equity Funds, and as per SEBI guidelines, they can take up a 65% exposure to this asset class.

How Are Mutual Funds Created?

It begins with an Asset Management Company (AMC) recognizing a potential profit registering opportunity in capital markets. It then undertakes the following steps to effectuate the creation of a mutual fund:

- The financial company then takes a detailed view of the situation and analyses the upsides and downsides of their scheme against competitors.

- Subsequently, fund managers are appointed and handed the responsibility of defining the components of the portfolio. Depending upon the securities, the fund would then be classified as an Equity, Debt or Hybrid Mutual Fund.

- Drafts of the scheme are submitted with the market regulator aka Securities and Exchange Board of India (SEBI).

- Following approval from SEBI, the financial scheme is then opened to investors for capital curation through a New Fund Offer (NFO) which offers a subscription period of 7 – 10 days.

Open-ended Mutual Funds allow investors to exit the scheme post the closure of the NFO period. Contrary to this, close-ended Mutual Funds prohibit the exit of investors during the lock-in period and allow the same after the scheme matures.

Want to Learn More about Mutual Funds?

NIIT’s Post Graduate Programme in Banking and Finance is a best-of-breed training programme that develops students with a multi-faceted professional outlook. The course works ground-up building strong fundamentals across the following domains:

- Banking

- Financial Services

- Capital Markets

- Financial Technology

Banking has evolved and so have the Key Responsibilities Areas associated with its job roles. Recruiters hiring for major banks expect job candidates to wear multiple hats and in essence, be aware of the operational knowledge of interrelated departments. In light of that NIIT brings forth its industry-aligned curriculum:

- Banking, Financial Services and Insurance industry foundation

- Sales skills

- Financial Products (Assets, liabilities, loans, mortgages etc.)

- Insurance Products (Life Insurance, General Insurance, Mutual Funds etc.)

- Customer Service and Relationship Management

- Financial Analysis

NIIT acknowledges the fact that learning never stops, as a result of which we also prepare students for NISM certification exams to strengthen their prospects. Are you game for a career in banking?

Post Graduate Programme in Banking and Finance – Sales and Relationship Management

An online blended learning programme for graduates that prepares you in fields across Banking, Financial Services, Capital markets, Fintech and regulatory bodies & many more.

Become All-Rounded BFSI Professional

3 Assured Placement Interviews*

Sign Up

Sign Up

Reviewed on 19th May 2024