Axis Bank is the third largest private sector bank in India offering entire spectrum of financial services for personal & corporate banking.

Start with Axis Bank

Assured Job as Deputy Manager – Axis Bank

Kick-Start Your Career in 6.5 Months @Axis Bank

Starting Salary of Rs.5 LPA**

Assured Career @Axis Bank

Value Proposition

- Get Admission Offer letter on successful completion of screening process

- Kick-start your career as Deputy Manager

- Start earning salary after 7.5 months of training and internship

- MBA Level Starting Salary of 5 Lakhs**

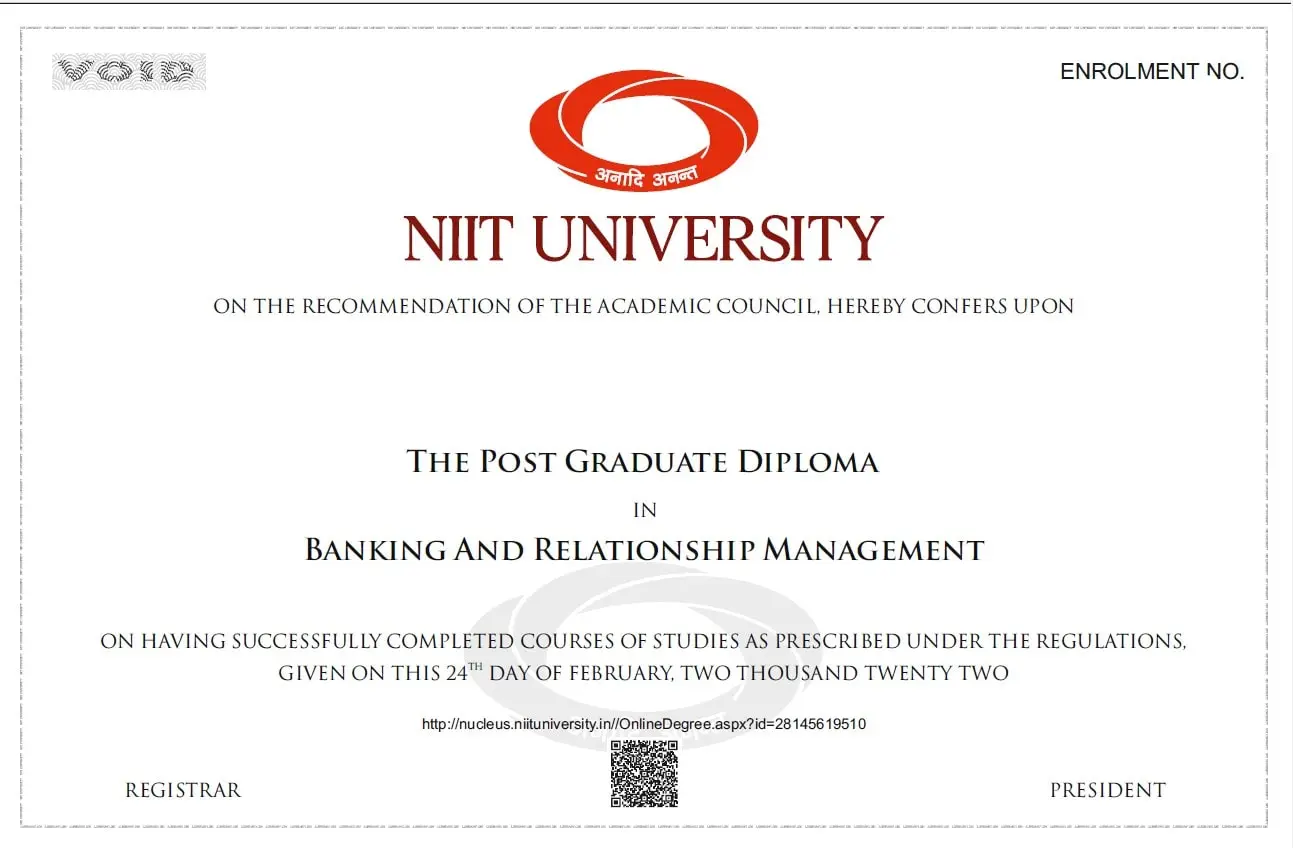

- 1 Year PG Diploma from NIIT University

Program Fee

Rs. ( Excluding GST @ 18% )

For more payment options

Program Details

Programme Structure

6 Month Residential Training @ NIIT University

- Banking Processes & Products I & II

- Management Accounting & Control

- Marketing & Economics

- Managerial Communication

- Business Statistics & Financial management

- Commercial Banking I & II

- Indian Financial System (IFS)

- Financial Planning & Wealth Management

- Customer Relationship Management

- Digital Banking

- Selling Skills and Relationship Management

- Investment Analysis & Portfolio Management

1 Month Internship @ Axis Bank & 15 days Online Refresher Training

- Online Refresher Training

- Structured internship diary

- Hand holding at branches

- Mentorship by NIIT faculties

4.5 Month On the Job Training @ Axis Bank

- Team support

- Mentoring by seniors

- Business Goals to help align to business expectations

Post Graduate Diploma

Career Path

Eligibility Criteria

Qualification & Other Eligibility Criterion:

- Graduation or Post Graduation from any stream with 50% and above

- Candidates who have appeared and are awaiting results of Final year of Graduation /Post Graduation are also eligible for the program. However Original Final Year Marks sheet & Degree certificate shall have to be submitted on Joining the Program

- 10th, 12th & Graduation should be in regular mode (Correspondence, Distance Learning, Vocational, Open Schooling are not allowed)

- Graduation Degree (10+2+3 Pattern) is Compulsory

- 50% in 10th, 12th & Graduation

- Good Communication Skills

- 2 Years Gap in Education allowed between 10th & Graduation

- 0-3 Years of Work experience

- Age >20

You would NOT be eligible for this program if:

- You have a relative working at Axis Bank in accordance to the relative hiring policy of the Bank. Moreover, if two relatives get selected for the program, candidate with lower assessment score will have to withdraw their application.

- You have been subjected to any disciplinary proceedings by your previous employer(s) at any time.

- You have ever been proceeded against or convicted under any criminal statutes or in a consumer forum.

- Any legal action is pending or proposed to be initiated against you

Disclaimer:

Before applying, the candidate should ensure that he/she fulfils the eligibility and other norms mentioned.

In case, it is detected at any stage of the selection that a candidate does not fulfil the eligibility norms and/or that he/she has furnished any incorrect/false information/certificate/documents or has suppressed any material fact(s), his/her candidature will stand cancelled. If any of these shortcoming/s is/are detected even after admission / appointment, his/ her admission / services are liable to be terminated.

In case, you have worked previously with Axis Bank, and if basis rehire policy of the bank, you are not found eligible to be rehired via this program, then bank will cancel your application in accordance to the rehire policy of the Bank.

Decision of the Bank in all matters regarding eligibility of the candidate, the stages at which such scrutiny of eligibility is to be undertaken, the documents to be produced for the purpose at the time of conduct of examination, interview, selection and any other matter relating to recruitment will be final and binding on the candidate. No correspondence or personal enquiries will be entertained by the bank in this behalf.

NOTE:

Shortlisting at any stage during the application or selection process will be done basis bank’s criteria. The student's education qualifications and background will be verified by the Bank through an external agency. The details provided by the student at the time of application/selection need to be authentic which are subject to verification. Once the Agency confirms the authenticity of these details only then the candidate will be

Address Proof/Identity Proof/Signature Proof

Passport

Driving License

VOters Identity Card

NREGA Card

Birth Date Proof (Any 1 document)

Passport

Driving License

Birth Certificate

School Leaving Certificate

SSC/HSC Certificate

Election Card/Voter Card

ID Required

PAN Card (Mandatory)

Aadhaar Card issued by UIDAI (Mandatory)

Academic Certificates (All Original Documents)

10th SSC & 12th HSC Mark sheets

Graduation Certificate, Mark Sheet

STEP 1:

Register yourself by completing your online application form on this site. Please note, your application will be considered for further processing only when it is completed, including the payment of application fee. This application fee is for the purpose of the assessments and does not guarantee selection for the this program or employment with Axis Bank.

STEP 2:

The selection process consists of 3 stages:

- Online Assessments (Proctored)

- NIIT Panel Interview (Online)

- Axis Bank Panel Interview (Online)

STEP 3:

The selected candidates will be issued Letter of Intent (LOI) by Axis Bank. On completion of the admission formalities, the selected candidates shall be enrolled for the program.

Selection Process

Learning Outcomes

Role Clarity

Knowledge and Toolset

Grooming & Communication

Customer Acquisition

Deepen Customer Relationships

LIFE @ NIIT University

Award Winning & Well Maintained Campus

90 Minutes away from Delhi Airport

Walled Campus and 24-Hour Security

State of The Art Accommodation and Infrastructure

Award Winning & Well Maintained Campus

90 Minutes away from Delhi Airport

Walled Campus and 24-Hour Security

State of The Art Accommodation and Infrastructure

Program Mentors

Dr. Sushil Kalyani

PhD in Accounting & Finance from the Department of Accounting and Business Statistics, University of Rajasthan. He has done his PGCPF from IIM Indore.

Dr. Sushil Kalyani

Dr. Sushil has earned his PhD in Accounting & Finance from the Department of Accounting and Business Statistics, University of Rajasthan. He has done his PGCPF from IIM Indore and has done MBA in Finance, MA in Business Economics, PG Diploma in Foreign Trade, PG Diploma in Financial Management, CA (Inter), ICAI’s Accounting Technician Certificate Program and has qualified UGC NET (Management).

In his overall experience of 19 years in academics and corporate, he has worked with various institutes including IMI – Bhubaneswar and IIS University Jaipur. In his stint with corporate world, he worked with a Dubai based company in the capacity of Reginal Financial Controller and has handled 25 branches of the company situated in African continent.

Prof. Arun Kumar

An IIM Indore alumnus, is presently working as an Associate Professor at NIIT University.

Prof. Arun Kumar

Professor Kumar, an IIM Indore alumnus, is presently working as an Associate Professor at NIIT University, teaching various course related to Banking & Finance to MBA & PGDBM students. His research interest lies in the field of e-Financial Inclusion & Banking Risk Management.

He is a highly accomplished professional with over 30 years’ chronicle of success and a track record of working with reputed & well-known Government owned Banks (including State Bank of Bikaner & Jaipur, Punjab & Sind Bank & UCO Bank) and Best International Rating Agency & Risk Consultant (Dun & Bradstreet Dubai). He has been associated as Consultant (Deputed to Lagos, Nigeria) with Dun & Bradstreet Dubai where he spearheaded the implementation of Basel-II/III, formulation of ICAAP and other credit & operational risk consultancy at Nigeria.

Bhawna Roherra

Command areas include retail banking, international banking, soft skills and Finacle software.

Bhawna Roherra

With over 25 years of experience in the Banking industry, Bhavna Rohera brings a vast amount of knowledge and experience into her training. She has worked with Indian Overseas Bank as well as HSBC Dubai UAE.

Senior trainer with NIIT IFBI, she has been a trainer in the BFSI sector for more than 8 years. She is a passionate, enthusiastic, adaptable team player who is always willing to learn and improve. Her goal is to make learning fun.

Gayathri Anand

Rich experience in Retail Branch banking (Asset and Liabilities), Trade Finance, Corporate loans, Credit management for MSME, and mid corp.

Gayathri Anand

Gayatri Anand, BFSI trainer with an experience of 12 years in Retail Branch banking (Asset and Liabilities), Trade Finance, Corporate loans, Credit management for MSME, and mid corp.

Gayatri has been associated with IFBI for about 7 years and managed the education delivery for Pune. She has an MBA degree in HR and certification in CAIIB.

Vivek Chopra

Vivek is a graduate in Commerce and Hotel Management and a Masters in Business Administration.

Vivek Chopra

Vivek is a programme mentor at IFBI and brings 18 years of BFSI industry experience. He has worked in Retail and Commercial Banking with Kotak Mahindra Bank, ICICI Bank, and American Express.

He has managed a team of RMs and the customer portfolios during his tenure as a Cluster Manager and Commercial Banking Manager. He has conducted various training programmes for SBI, KVB, HDFC Bank, Small Finance and Payments Banks, KBL, and India Post.

The NIIT IFBI Advantage